Data management is essential for any organization, from small startups to large enterprise brands. While founders built younger companies with smart data management in mind, established brands with decades of operational history face a larger challenge in reorganizing and revamping their data. But modernization is not optional—it is critical for the efficiency of internal teams to provide customers with the services they demand.

Anadolu Sigorta faced such a project that ultimately transformed our environment into a well-integrated, reliable system that enables daily and real-time reporting.

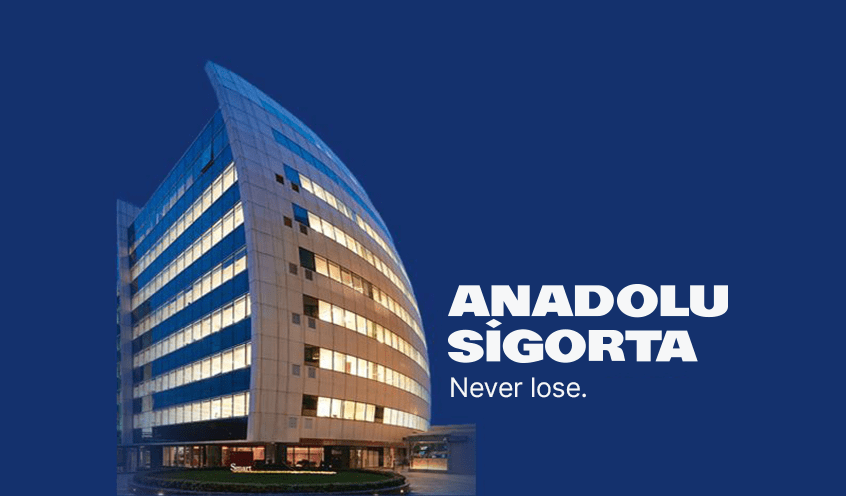

A Turkish institution

Anadolu Sigorta is a leading Turkish insurance company founded in 1925. With more than 2.8 million active customers, it’s the largest and oldest insurance company in the nation. The company’s motto is “never lose,” which is embodied by many of its pioneering services. We were the first Turkish insurance company to offer travel insurance in 1974, and we’ve offered online insurance sales as far back as 2000.

Quote: “Modernization is critical for the efficiency of internal teams to provide customers with the services they demand.”

Anadolu Sigorta is a tech school at heart. We adopt dozens of technology platforms so employees can improve their skills. I have a front row seat to this as the team manager for data and business intelligence (BI). My division is responsible for self-service BI, which includes ETL, data analytics, and cross system integration.

Our department wants to help everyone on our team make more informed decisions. For that, we need reliable data, but our previous data warehouse was far from reliable. We had to overcome several obstacles before launching any larger analytics projects.

A legacy system that created chaos between teams

Anadolu Sigorta is a non-life insurance company, so we insure various risks. We have a lot of structured and unstructured data flowing into our systems, which makes proper data management key to our success.

Our legacy data management system couldn’t keep up with the influx of data. It was slow and outdated, which created data integrity issues on a weekly, sometimes daily, basis. We couldn’t even provide stakeholders with monthly profitability reports: the data losses and reconciliation failures were too difficult to manage.

Even if we tried to present profitability reports to stakeholders, they wouldn’t (and couldn’t) trust the data to be accurate. These inaccuracies created chaos between our data warehouse and database administration (DBA) teams and led to multiple inefficiencies in our existing data warehousing process.

Our goal was to make our data warehouse more dynamic, so it would process data instantly and transform it into information that users could actually use.

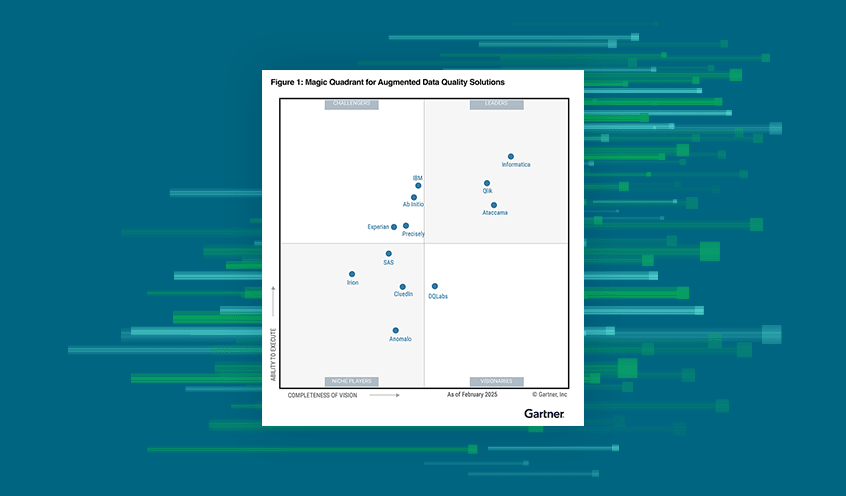

Choosing Qlik as a modernization partner

It was a big undertaking, and it didn’t take long to select Qlik as our partner for the project. We used Qlik Data Integration, which gave us real-time data delivery and data warehouse automation with the following solutions:

Qlik Replicate, which can load, ingest, migrate, distribute, consolidate and synchronize large amounts of data across multiple data sources and deliver data in real-time

Qlik Compose for Data Warehouses, which automates data warehouse design, generating ETL code as push down SQL to modern cloud data warehouse and applying updates

Qlik’s data accuracy and reliability were major selling points. After testing Qlik Replicate and Qlik Compose for several weeks, we found no mismatched data or missing pieces. Our previous vendor had never been that reliable, which made us even more excited that we were on the right path.

Once we decided on Qlik Data Integration, the project moved quickly: we replaced our legacy system with Qlik in just three months.

Quote: Today, we have more than 1,800 tables to work with and can transfer huge amounts of data to the warehouse, sometimes up to one billion transactions per day.

Today, we have more than 1,800 tables to work with and can transfer huge amounts of data to the warehouse, sometimes up to one billion transactions per day.

Business impacts of trustworthy, real-time reporting

Gone are the days of customer complaints due to delays, missing and incorrect data issues, or insufficient monitoring systems. The user interface is easy to use, development processes are simple to execute, and we don’t need DBA licenses to access our system.

Qlik Data Integration has resolved our previous issues completely, and we’ve seen a host of benefits:

100% data consistency. No more worrying about inconsistencies or problems with data losses.

Data profitability reports. We have clean, trusted data to share with stakeholders, who can make more informed business decisions faster.

Access to real-time data. Our agents can access and renew insurance policies instantly, leading to better outcomes for customers and our team.

Easier to verify and test environments. Before, we were unable to perform tests. Now, we can test data flows and the test environment has eliminated the overload on the source database. We also reduced the load on the production environment because we are connected to the Oracle Data Guard environment.

AI fuels more effective fraud detection. Our infrastructure consists of multiple systems, including 10 different Oracle databases and one DB2 AS400 database. We stream all of this data into our data warehouse. With real-time data points rather than stagnant statistics, we incorporated a 24/7 fraud monitoring system and filtered out hundreds of fraudulent claims. We realized an approximate 15–20% increase in the detection of fraudulent claim payments compared to the previous year.

The next 100 years

A couple of years ago, it would have been impossible to perform any of these projects. But thanks to Qlik Data Integration and its real-time data architecture, we have been able to experiment in ways that will ensure our business can succeed in the era of Big Data.

Quote: “Regardless of whether your business is large or small, inconsistent data will prevent you from reaching your true potential.”

Regardless of whether your business is large or small, inconsistent data will prevent you from reaching your true potential. Partnering with Qlik will save a lot of time and even more headaches, and you’ll have more accurate data as a foundation for all your work.

Qlik has helped Anadolu Sigorta stay competitive, offering our customers the services they need to stay on top. Anadolu Sigorta has reached an era of innovation, and we are excited to move forward into another century of modernization.