Financial Services Analytics

Disparate and incomplete information stands between events and actions. Qlik’s versatile data engine breaks down the complexity of disparate data, and delivers analytical insights to those who need it, instantly. Accurate information drives better decisions and profitable outcomes.

Explore Financial Services Analytics

Smarter decisions for banking – optimize risk, understand costs and maximize profit.

Banking is at an inflection point. Disruptive regulation and fintech innovation are accelerating change. Open banking means that banks need better information about their customers than ever before. Qlik’s data analytics help banks to make more competitive risk decisions, create first class customer experiences and solve a range of use cases from credit and market risk through to embedded analytics using open API’s.

-

Improving cash-management in bank branches

See how Teachers Credit Union boosted referrals by 207% by better forecasting demand, reducing costs while still meeting customer needs. -

Banking industry-leaders round-table on key industry challenges and solutions

See how leading global banks are solving some of their toughest challenges using data analytics in this webinar from Qlik and ‘The Banker’.

Explore top financial services analytics resources

-

The Top 12 Solutions in Financial Services

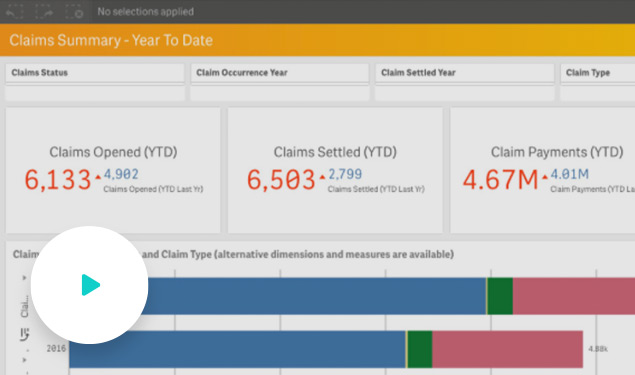

From underwriting to solvency ratios. Make better decisions, based on fact.

Without access to accurate data, insurers often make decisions based on gut instinct or intuition – creating compliance issues and missing opportunities. Using Qlik’s powerful data analysis engine, insurance firms can remove the uncertainty and see needed insights quickly.

-

Transform decisions across your key insurance systems

See how Deloitte and Qlik helped the State Auto Insurance company transform analytics and decision-making across their business as part of their Guidewire Implementation Program. -

Reduce your claims costs with effective fraud indicator analysis and transaction quality monitoring

Understand how the effective financial analysis of claims data can identify potential claims fraud, highlight erroneous claims transactions and incentivize better team performance. -

Insurance industry leaders gain a competitive edge through advanced analytics

See how leading UK insurance firms are using analytics to transform their organizations and stay competitive in today’s disrupted market in this webinar from Qlik and Insurance Post.

Accelerate risk and trading decisions, simplify complex mathematical problems and meet regulatory requirements.

Qlik’s Associative engine has been consuming trading book data at the world’s largest investment banks for years, helping them to allocate capital effectively, manage complex risk and trading scenarios, and meet the ever changing requirements of the regulator.

-

Moody's gains new actionable insights through data

Watch this credit risk webinar to see how Moody’s embedded Qlik into their platform to deliver advanced credit book analytics – improving capital efficiency and better managing exposure across asset classes.

Explore more Qlik resources for Financial Services

-

Webcast Lounge

Visit the Financial Services webcast lounge and access all the latest on-demand webinar sessions to hear experts share best practices and thought leadership across the industry. -

Financial Services Blog

Read the latest thought-leading perspectives from Qlik’s Financial Services industry team.